child tax credit after december 2021

It provided families with. Advanced child tax credits are expected to end in Dec.

Child Tax Credit How To Get Your Money If You Lost The Irs Letter Cnet

When taxes are filed in 2022 for the 2021 tax year parents will be able to cash in on the second half of their expanded child tax credit.

. During the pandemic will expire at the. Under the enhanced CTC families with children under 6 received a 3600 tax credit in 2021 with 1800 of that sent via the monthly checks or 300 per month. Under the American Rescue Plan of 2021 advance payments of up to half the 2021 Child Tax Credit were sent to eligible taxpayers.

However after Congress failed to agree to an extension before the end of the year the boosted Child Tax Credit expired after December 2021. You qualify for the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual income is not more than. To get money to families sooner the IRS is sending families half of their 2021 Child Tax Credit as monthly payments of 300 per child under age 6 and 250 per child between the ages of 6 and.

Nearly every family is eligible to receive the 2021 CTC this year including families that havent filed a tax return and families that dont have recent income. Visit ChildTaxCreditgov for details. 150000 if you are.

So a family with two children. For 2021 only the child tax credit amount was increased from 2000 for each child age 16 or younger to 3600 per child for kids who are 5 years old or younger and 3000 per. A childs age helps determine the amount of Child Tax Credit that eligible parents or guardians can receive.

2021 though you can still collect the remaining half of your credit either 1800 or 1500 when you file your 2021 tax. The final payment of the 2021 child tax credit is scheduled to be. Before that though families will see the final.

Thanks to the American Rescue Plan the vast majority of families will receive 3000 per child ages 6-17 years old and 3600 per child under 6 as a result of the increased 2021. The advance Child Tax Credit payments disbursed by the IRS from July through December of 2021 were early payments from the IRS of 50 percent of the amount of the Child. The Child Tax Credit reached 612 million children in December 2021 an increase of 2 million children over six months from the rollout to 593 million children in July.

For 2021 eligible parents or guardians can receive up to 3600 for each child who. Since July the Child Tax Credit previously a once-a-year credit has been sent out in the form of a direct payment worth up to 300 per month for eligible families. The 2021 temporary expansion of the child tax credit CTC was unprecedented in its reach lifting 37 million children out of poverty as of December 2021.

The monthly payments from the expanded child tax credit that have been given to roughly 35 million families in the US. The periodic payments from July 2021 through December 2021 will give you half of the credit as an advance to the eligible families or caregivers. The IRS used the information from your 2019 or 2020 tax return to estimate your eligibility for monthly Child Tax Credit payments in 2021 and send payments equal to half of the amount of.

The advanced Child tax credit payments are scheduled to end on December 15 2021. New study highlights the cost. WASHINGTON AP Its one of the most far-reaching of all the federal aid programs launched during the COVID-19 pandemic up to 300 per child going directly into.

Benefits Of Expanding Child Tax Credit Outweigh Small Employment Effects Center On Budget And Policy Priorities

Child Tax Credit 2022 How Much Money Could You Get From Your State Cnet

Child Tax Credit Definition Taxedu Tax Foundation

Stimulus Payments Child Tax Credit Expansion Were Critical Parts Of Successful Covid 19 Policy Response Center On Budget And Policy Priorities

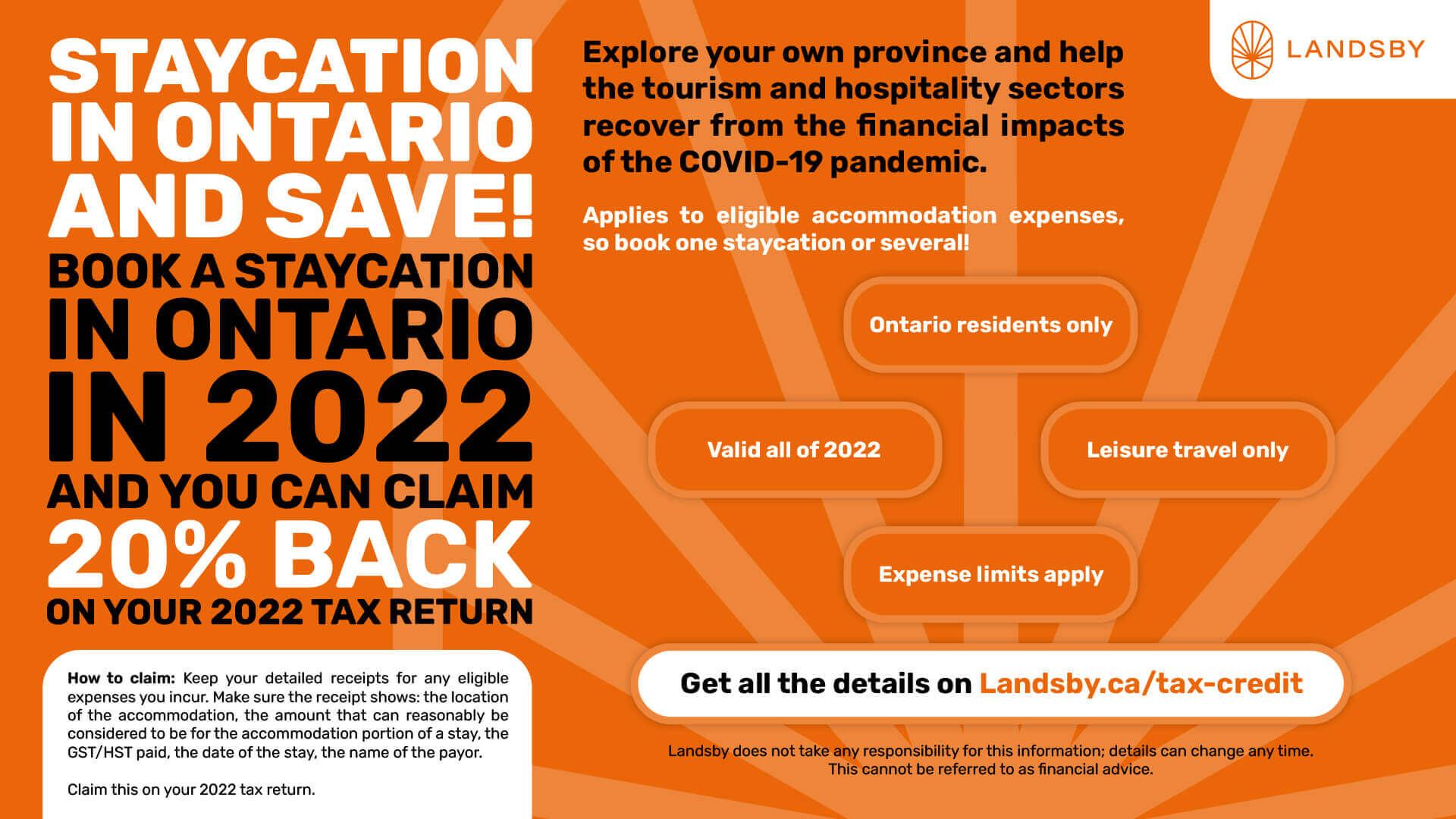

2022 Ontario Staycation Tax Credit Guide Landsby

Haven T Received Your Advance Payment Of The Child Tax Credit Issued To You Yet

Can Poor Families Benefit From The Child Tax Credit Tax Policy Center

Child Tax Credit Definition Taxedu Tax Foundation

Policy Basics The Child Tax Credit Center On Budget And Policy Priorities

Romney Child Tax Credit Proposal Is Step Forward But Falls Short Targets Low Income Families To Pay For It Center On Budget And Policy Priorities

Legislative Momentum In 2022 New And Expanded Child Tax Credits And Eitcs Itep

The Child Tax Credit Toolkit The White House

The Child Tax Credit Toolkit The White House

/cdn.vox-cdn.com/uploads/chorus_image/image/71300653/bigbill.0.jpg)

Will Child Tax Credit Payments Continue In 2023 The Fight Is Not Over Vox

The Child Tax Credit Toolkit The White House

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Irs Announced Monthly Child Tax Credit Payments To Start July 15 Forbes Advisor

Child Tax Credit Ending Will Push 10 Million Kids Back Into Poverty