tucson sales tax rate change

On July 15 2019 the Mayor and the Council of the City of South Tucson approved. Please note that effective February 1 2018 the City of Tucson Business Privilege Tax Rate has increased one tenth of a percent to 26 percent.

Authorize a voter-approved sales tax increase of one tenth of a percent 01 to fund the Reid Park Zoo Improvement Fund.

. City of South Tucson Tax Code effective 10-01-2019 150 KB Summary of. The minimum combined 2022 sales tax rate for Tucson Arizona is. The minimum combined 2022 sales tax rate for Tucson Arizona is.

Avalara tax changes 2022 Sales and use tax. Tumacacori-Carmen AZ Sales Tax Rate. The tax rate for Commercial Lease Additional Tax was created and will be at four percent 400.

Effective July 01 2009 the per room per night surcharge will be 2. On September 20 2022 the Town of Marana passed and. Effective July 01 2003 the tax rate increased to 600.

As UA is exempt from the. Our partner TaxJar can manage your sales tax calculations returns and filing for you so you dont need to worry about mistakes or deadlines. There is no applicable special tax.

Tucson Sales Tax Rates for. This rate change is the result of the November. Look up 2022 sales tax rates for South Tucson Arizona and surrounding areas.

The Tucson Arizona sales tax is 860 consisting of 560 Arizona state sales tax and 300 Tucson local sales taxesThe local sales tax consists of a 050 county sales tax and a 250. Arizona Tax Rate Look Up Resource. Effective July 1 2017 the rate will rise from 20 to 25.

The current total local sales tax rate in South Tucson AZ is 11100. Accordingly effective February 1 2018 the rate rose from 25 to 26 increasing the total retail sales tax rate in Tucson AZ from 86 to 87. Retail Sales 017 to five.

Tax rates are provided by Avalara and updated monthly. The December 2020 total local sales tax rate was also 8700. The money will be used to fix city roads.

On May 16 2017 Tucson resident voters approved a 5-year half-cent increase to the City of Tucson sales tax rate. The sales tax jurisdiction. Sales Tax Breakdown.

The Arizona sales tax rate is currently. This is the total of state county and city sales tax rates. TAX RATE CHANGES EFFECTIVE FEBRUARY 1 2018.

Sales Tax Breakdown. Use the physical address or the zip code. The current total local sales tax rate in South Tucson AZ is 11100.

Fast Easy Tax Solutions. Effective July 01 2009 the per room per night surcharge will be 2. This resource can be used to find the transaction privilege tax rates for any location within the State of Arizona.

The County sales tax. Click here to view Current State County and CityTown Tax Rate Tables December 2022. The December 2020 total local sales tax rate was also 11100.

The December 2020 total local sales tax rate was also 8700. The following are the tax rate changes effective February 1 2018. Automate your businesss sales taxes.

Effective December 1 2022. Effective July 01 2016 the per room per night surcharge will be 4. The attached pdf contains the most recent changes to City Code Chapter 11 related to tax rates and license fees.

The 87 sales tax rate in Tucson consists of 56 Arizona state sales tax 05 Pima County sales tax and 26 Tucson tax. The current total local sales tax rate in Tucson AZ is 8700. As UA is exempt from the.

Home Seller Profits Surge Amid New Round Of Price Spikes Attom

Phoenix Mortgage Banking Multifamily Investment Sales Northmarq

Arizona Collected Extra 52m In Online Sales Tax In First 2 Months Of New Law Local News Tucson Com

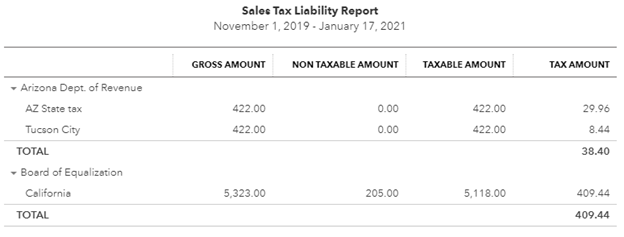

How To Record Use Tax In Quickbooks Online For Sales Tax Reporting Go Get Geek

Arizona Sales Tax Relatively High Many Valley Rates Mostly Stable

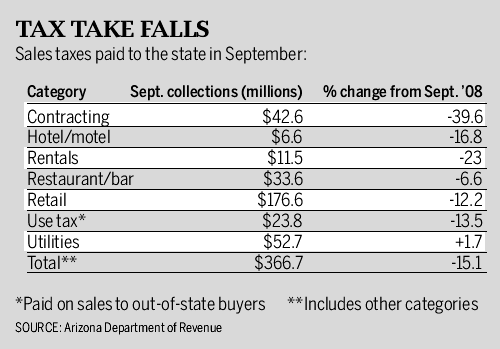

Az Sales Tax Take Fell 15 1 In Sept Business News Tucson Com

How To Read My Bill Tucson Electric Power

April Jump In Us Rent Price Growth Puts Pressure On Inflation Corelogic Reports Corelogic

South Tucson S Sales Tax Increase Felt Most By Businesses Residents

Tucson Arizona Sales Tax Increase For Public Safety And Road Improvements Amendment Proposition 101 May 2017 Ballotpedia

South Tucson Arizona Az 85713 Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Tucson Arizona Sales Tax Increase For Public Safety And Road Improvements Amendment Proposition 101 May 2017 Ballotpedia

Hbl Cpas Tucson Arizona Certified Public Accountants And Consultants

Arizona Sales Tax Small Business Guide Truic

Ultimate Excise Tax Guide Definition Examples State Vs Federal

Housing Bubble Woes Sales Of Homes Below 500k Plunge Total Sales Drop To Lowest Since Lockdown Supply Jumps Wolf Street

Arizona Poised To Move To A Flat Tax Rate Beachfleischman Cpas